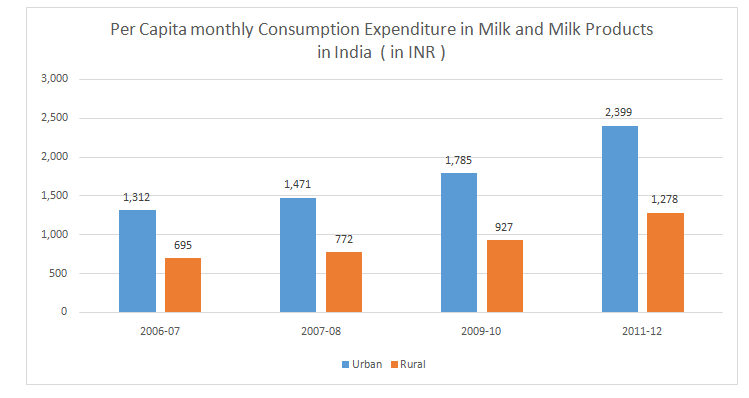

India is the largest producer of milk in the world. The milk revolution (“Operation Flood”), started by NationalDairy Development Board (NDDB) in 1970, transformed India from being milk deficient to the largest milkproducer in the world. The Indian Dairy industry is at the verge of another revolution, moving towards increasedcontribution from various milk products. The industry in India is aggressivelytransitioning from just plain vanilla loose/ pouch milk to value-added products (VAP) market and fromunorganized/local to more of an organized and branded market. The shift fromunorganized to organized market and from liquid milk/ powder to value-added dairy products will provide longtermgrowth visibility to the organized dairy sector. The value added products though capex-intensive inthe initial phase, will improve the margins and return on investments over long run for the companies in thesector. The demand for value-added products will be driven by changes in macro-economic factors like increasein urbanization, nuclear families, working women and improved per capita spending.

The Indian dairy industry is divided into the organized and unorganized segments.The unorganized segment consists of traditional milkmen, vendors and self-consumptionat home, and the organized segment consists of cooperatives andprivate dairies. As per the Annual Report for FY17 of Dept. of Animal Husbandry,Dairying & Fisheries, Ministry of Agriculture & Farmers Welfare, GOI, co-operatives &private dairies still procure only about 20% of the milk produced in the country, while34% is sold in the unorganized market and about 46% is consumed locally. However,in most of the developed nations, 90% of the surplus milk is processed throughorganized sector.

There is significant potential for the organized sector to gain market share of marketable milk from unorganized sector by introducing standardization in milk qualitytesting and transparency in computing consideration being paid to farmers for their milk along with educating farmers on best dairy and animal husbandrypractices. This could also dovetail well with the shift of consumer preference from unorganized to organized market. As per the Department of AnimalHusbandry, Dairying and Fisheries, the organized milk handling is expected to grow from 20% at present to 50% by 2022-23.

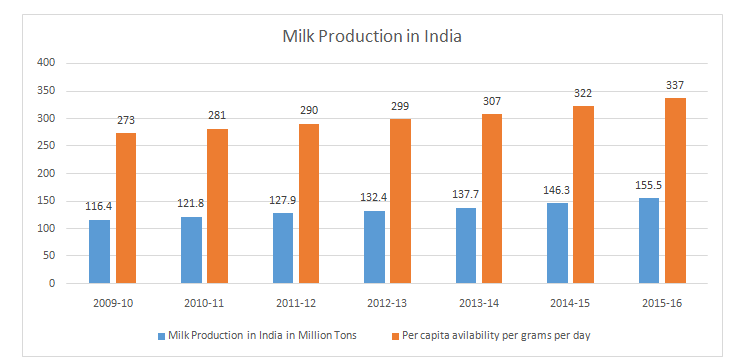

Dairy industry in India grew at a CAGR of approximately16% in the last 5 years ending 2016, and milk production has grown at a CAGR of 5%. The total production of milk and dairy products in India is expected toincrease from 147 MMT in 2015 to ~190 MMT in 2021, and total consumption of milk and dairy products is expected to increase from 138 MMT in 2015 to ~200MMT in 2021. India’s dairy industry is expected to maintain growth at a CAGR of 14% to 15% over 2016 to 2021. The growth would be primarily driven byincrease in the demand for value-added milk products. Value-added products are expected to grow at 19%-20% and liquid milk is expected to maintain growthrate of 3%-5%. This will prove beneficial to the organized sector and prove a catalyst in the shift of the industry from unorganized to organized players.

Government of India is making efforts for strengthening the dairy sector through various Central Schemes such as “National Programme for Bovine Breedingand Dairy Development” and National Dairy Plan (Phase-I).

- • The restructured Scheme National Programme for Bovine Breeding and Dairy Development (NPBBDD) was launched in 2014 with the budget provisionof Rs.1,800 crore for implementation during 12th Plan.

- • Actual implementation of National Programme for Bovine Breeding has been initiated from 2014-15. Till November 2016, 27 projects from 27 states with thetotal project cost of Rs.1,077.83 crore have been approved, and out of this, amount of Rs.332.91 crore has been released to the states for implementation ofthe project including funds released under the RashtriyaGokul Mission.

- • In order to meet the growing demand for milk with a focus to improve milk animal productivity and increase in milk production, the Government hasapproved National Dairy Plan Phase-I (NDP-I) in February 2012, with a total investment of about Rs.2,242 crore to be implemented from 2011-12 to2016-17. As per the NDDB report, total fund utilization till September 2016 has been Rs.945.25 crore out of which Rs.780.28 crore is NDP-I grant andRs.164.97 crore is the contribution of Implementation Agencies implementing sub projects. This will prove beneficial to the dairy and livestockproduction in the coming years as it will improve productivity and cattle numbers.

Furthermore, the following incentives have also been provided by the Government in relation to cold chain facilities:

- • Section 80-IB of the Income Tax Act provides deductions in respect of profits from industrial undertakings related to Cold Chain. For the first 5 years, thedeductions are @ 100% and then @25/30% for next 5 years.

- • Under Section 35-AD of the Income Tax Act 1961, deduction @ 150% is permitted for expenditure incurred on capital investment in setting up a coldchain facility

Major competitors in the market include Amul, Mother Dairy, Nestle, Danone, Kwality, Hatsun Agro, Heritage Foods, Paras Dairy, Parag Milk Foods, Creamline Dairy, Aavin, and Nandini. Trends supporting market growth include:

- • Steady expansion of the organized sector

- • Opportunities to differentiate basic products

- • Urban consumer preference for convenient, healthy yet indulgent products that increase premiumization

- • User disposition toward the taste of dairy-based health products despite the availability of several non-dairy substitutes

- • Demand for and hence opportunity to create new categories in functional products and single serving units; and

- • High acceptance of new brands in the wellness and premium segment, which enables easy market entry for new players.